Your Community

Our Best-Selling Used Cars in NZ 2025

12 Dec 2025 Buying A Used Car ArticlesIf you want a reliable, practical and good-value used car, starting with the models people trust most is a smart move. Here’s a quick guide to our best-selling used cars of the year, based on real sales across our nationwide yards.

The most economical used cars in NZ

03 Sep 2025 Buying A Used Car ArticlesA used car can deliver everything you want and need and still be truly economical. Let’s take a look at the best small, medium and large options – including how to understand and research how efficient each model is.

The cheapest reliable used cars in NZ right now

19 Aug 2025 Buying A Used Car ArticlesFinding a cheap used car under $10k that’s also reliable and economical is not as hard as you think! We've got you covered, these models deliver great value, low running costs, and peace of mind.

What to consider when buying a 2nd hand car

10 Feb 2025 Buying A Used Car ArticlesHow do you choose your next used car? Well, how long’s a piece of string? But nailing down a few priorities, needs and wants can help you create a shortlist and go shopping with confidence.

How to make sure your car retains its value

10 Feb 2025 Looking After Your CarYou’ve made the big decision to spend money on a car, but after that you’ll want to make sure it’s still worth maximum money when you sell it again. Here are some simple steps you can take to make sure your car retains its value.

The top-selling used cars this year

13 Dec 2024 Buying A Used Car ArticlesThere’s strength in numbers: once you know the most popular used car brands and models, you know where to start looking for your new ute, SUV or hatch. So here they are.

Our best used cars under $10k

12 Dec 2024 Buying A Used Car ArticlesAre you looking to buy a great used car for under $10k? The good news is that this price bracket is full of great, reliable models from Toyota, Mazda, Nissan, Mazda, Suzuki and Honda.

The best way to sell your car

05 Dec 2024 Buying A Used Car ArticlesWhat’s the best way to sell your car? Conventional wisdom says it's best to sell privately, but actual wisdom suggests direct to a dealer can get you as much money (or more), as well as less hassle and risk.

Guide to Buying a Used Hybrid in NZ

01 Oct 2024 Electric and Hybrid VehiclesHybrid and Electric cars are increasingly popular in New Zealand. When they were first launched to the market they were not affordable for most New Zealanders, but now that there are more of them on the road, they are much more affordable to purchase.

Trading In A Car Considerations

30 Sep 2024 Buying A Used Car ArticlesIs it a good idea to Trade-in your car? For most people, trading in your car at a dealership is a convenient solution to a problem, especially if you still owe money on it. You simply drive your car into the dealership and they appraise it. This means they inspect...

Zero Deposit Car Finance

26 Sep 2024 Car FinanceDreaming of owning a car but struggling to save for a deposit? With zero deposit car finance, you can get behind the wheel without needing upfront savings. This flexible option allows you to finance your vehicle entirely, making it easier than ever to access reliable transportation. Do I need a...

Why Now is the Perfect Time to Buy a Used Car from Enterprise Motor Group

25 Sep 2024 Buying A Used Car ArticlesIn today's economic climate, with fluctuating interest rates and persistent inflation, many consumers are feeling the pinch. But don't worry, there's a silver lining in the clouds: Enterprise Motor Group has a solution for you!

Celebrating 55 Years of Excellence: Honouring Fred Lewis of Enterprise Cars

04 Jun 2024 Community News55 Years of Excellence: Celebrating Fred Lewis and Enterprise Cars

Buying Your First Car Guide

30 May 2024 Buying A Used Car ArticlesPurchasing your first car is a significant step. It symbolises independence and opens up a world of possibilities. However, the process of buying your first car can feel daunting. This guide to buying your first car aims to demystify the process and provide you with the essential knowledge you need....

Enterprise Motor Group: Your Go-To Destination for Quality Used Cars in Auckland

30 May 2024 Community NewsFor the past four years, from 2020 to 2024, Enterprise Motor Group (EMG) has been honoured with the Highly Commended Award for Most Trusted Brand. This consistent recognition underscores EMG's unwavering commitment to excellence in the automotive industry

Conquering Winter Roads: Top Tips for Safe Driving in New Zealand

20 May 2024 Community NewsWinter throws some curveballs at Kiwi drivers. From frosty mornings to surprise downpours, navigating the roads requires extra caution and preparation. At Enterprise Cars, we want your winter journeys to be safe and smooth.

From Windscreen Glances to Online Odysseys: How Tech Transformed Buying Used Cars in New Zealand

26 Apr 2024 Buying A Used Car ArticlesBuying a used car used to be a weekend adventure. Armed with a crumpled newspaper ad and a sceptical eye, you'd scour car yards, hoping to find a gem amidst the lemons. The rise of technology, however, has completely transformed this process.

The Smart Buyer's Guide to Financing Your Used Car

18 Mar 2024 Car FinanceIn the exciting journey of purchasing a used car, finding the right financing option can make all the difference. At Enterprise Cars, we know how important it is to make a smart choice. We're here to help.

Drive Easy: Why Our 4-Year Warranty Makes Buying Used Feel Brand New in NZ

18 Mar 2024 Buying A Used Car ArticlesWorried about buying a used car? Skip the brand-new price tag and get peace of mind with Enterprise Motor Group's 4-year warranty. It covers major repairs, breakdowns even when traveling, and offers unlimited claims for maximum security. Don't stress abou

Ten Tips to Reduce the Cost of Running Your Car

28 Feb 2024 Car FinanceSave money on your car! Learn 10 smart tips to cut running costs, from fuel savings to maintenance and finance advice.

Buy Used Cars Online

29 Nov 2023 Buying A Used Car ArticlesWe’re proud to be able to offer our customers a 100% paperless process! So if you want to buy from home or would just prefer to save a tree all you need to do is ask and we can go paperless together.

Used Car Loan Tips For Application

24 Nov 2023 Car FinanceFinding the best used car loan finance to suit your budget.

Gizzy local wins Isuzu ute giveaway at Fieldays 2023

25 Aug 2023 Community News“I saw the Isuzu utes at the gate when I arrived at Fieldays, but never ever thought I would win” said Callum

Advantages of buying a Hybrid car in NZ

19 Jul 2023 Electric and Hybrid VehiclesDid you know that a petrol-electric car like a Toyota Aqua hybrid will be at least 30 per cent more economical than an equivalent petrol one, and often much more?

There will never be a better time to buy a second hand Hybrid import

11 May 2023 Electric and Hybrid VehiclesThe Government is making changes to the clean Car Discount programme from July 1 – taking rebates away from hybrids and increasing fees even further on higher-emitting vehicles.

What's the difference between hybrid cars and EVs?

13 Apr 2023 Electric and Hybrid VehiclesIn 2022, more Kiwis bought non-traditional powered vehicles than ever before. The two most popular alternatives power types were hybrid and electric vehicles (EVs) - so what are the differences between a hybrid and an EV?

Good Credit Counts - for Car Loans and More

16 Feb 2023 Car FinanceBeing aware of exactly what’s in your credit report and what you can do to make sure your credit score is as high as possible will help you when it comes to getting finance. This article explains why this is important and provides some tips on what you ca

Thanks for trusting us New Zealand!

31 Oct 2022 Community NewsWe are proud to have been named one of NZ’s most trusted used car brands in the Readers Digest 2020 Trusted Brands Survey.

Thanks for trusting us again New Zealand!

31 Oct 2022 Community NewsLast year we were voted one of New Zealand’s most trusted brands, this was the first year that Used Vehicle Dealerships became a unique category separated from manufacturer brands and our inaugural Highly Commended was a proud moment for us all. The pride and excitement did not diminish when we...

The Basics of Finance

31 Oct 2022 Car FinanceCar finance is an alternative to saving. Choosing finance lets you get your car now and pay it off in easy weekly payments. What is pre-approval?As part of your decision-making process you will need to determine your budget.Getting pre-approved does not commit you to buying from that dealer or taking...

Need to knows when applying for a Car Loan in NZ

31 Oct 2022 Car FinanceWhat do you need to know before you apply for a car loan? If you’re getting ready to jump into the driver’s seat of a new car, you might be tempted to accelerate the process and make your purchase as soon as you can. And that might mean getting your...

Top Four Tips to Get the Most out of Your Car Loan

31 Oct 2022 Car FinanceStay in control of your car loan with tips to pay it off faster, reduce interest, and manage repayments wisely.

Bad Credit Car Finance

31 Oct 2022 Car FinanceMost of the time, when a finance company talks about ‘bad credit’ they are referring to a low credit score or poor credit report. We may be able to help you with car finance even if you have had bad credit in the past.

Tips for Test Driving a Car

31 Oct 2022 Buying A Used Car ArticlesIf you’re planning on buying a car, it’s a good idea to take it for a test drive. Even the most experienced drivers can get distracted from the details when they’re driving something different. We recommend you read our guide to getting the most from a test drive. It will help...

Driving on Winter Roads

31 Oct 2022 Looking After Your CarWinter can be a challenging time to be on the roads. There are a variety of weather conditions that can make driving more challenging than normal. It’s not unusual to encounter extreme weather that can lengthen your journey time and threaten your safety on the road. The good news is...

Why buy a 2nd hand ute?

13 Sep 2022 Buying A Used Car ArticlesUtes provide off-road strength and towing ability, but models like the Ford Ranger and Nissan Navara can be as much for family and weekend life as they are for hard work. So why have they become so popular?

Our best selling second-hand SUVs

13 Sep 2022 Buying A Used Car ArticlesThere are a multitude of SUVs out there to choose from, but some are firm favourites with buyers. Here’s what you need to know about our most popular second hand SUVs: the Nissan X-Trail, Mitsubishi Outlander and Nissan Murano.

Our best selling second-hand utes

13 Sep 2022 Buying A Used Car ArticlesOur Range of top-selling utes: Ford Ranger, Nissan Navara and Holden Colorado, stretch all the way from workhorse toughness to stylish weekend transport. Let’s take a detailed look at each.

Why buy a used SUV, and what makes them so good?

13 Sep 2022 Buying A Used Car ArticlesKiwis simply can’t get enough of SUVs, but what makes an SUV so good? How are they different and what are the advantages of buying a second hand SUV?

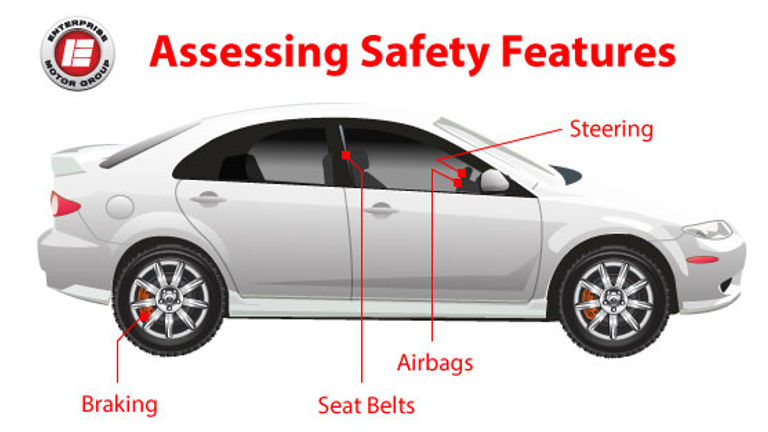

Safety counts! Assessing safety features when buying a car

05 Aug 2022 Buying A Used Car ArticlesIf you’re in the process of buying a car you’re probably busy considering all the features and fittings that you’d like to invest in. Are you keen on a bigger engine or fatter tyres? Or perhaps you’re prioritising interior space so you can fit in the kids, the dog, and...

How to Buy a Car - the First Steps

05 Aug 2022 Buying A Used Car ArticlesDeciding what type of car to buy can be scary! A good place to start is to think about what is going to be the most practical for you and your family. Here are some things to consider when you start thinking about buying a car.

Car Smart Buyer's Guide

05 Aug 2022 Buying A Used Car ArticlesBuying a car is a big decision and making sure you get the right car is important. The Car Smart Buyer's Guide combines our knowledge and experience in an easy to follow format, designed to help take the stress out of buying your next car. This free eBook will tell...

Buying your child's first car

05 Aug 2022 Buying A Used Car ArticlesSo your child is ready for their first car and you’ve decided to help them on their journey. We take a look at how to consider your finance options and some tactful ways to steer them away from a sports car and towards a smart purchase. Let’s talkHowever you choose...

How to choose the right car for your family

05 Aug 2022 Buying A Used Car ArticlesHow to choose the right car for your family and what to consider; the right size, budget, safety rating and vehicle type.

Our top selling second-hand Nissan cars

29 Apr 2022 Buying A Used Car ArticlesNissan has been a design leader in SUVs and utes over the years, which is why the X-Trail, Murano and Navara are so sought-after as used cars. Let’s take a look at our best sellers.

Why Nissan is one of our top-selling brands

29 Apr 2022 Buying A Used Car ArticlesThere’s something about the Nissan brand that really resonates with Kiwis. It’s one of our most popular brands overall and several Nissan models are among our individual top sellers including the Nissan X-Trail and Murano SUVs and Nissan Navara Ute.

Why Mazdas are good cars

29 Apr 2022 Buying A Used Car ArticlesMazda seems to have achieved that elusive balance between huge appeal for a broad range of buyers and genuine desirability for those who want something a little bit special or sporty. What is it about Mazda that makes the company a little bit different?

Our top selling Toyota cars

29 Apr 2022 Buying A Used Car ArticlesToyotas are famed for their dependability. But you might also be surprised at the sheer range of models available!

Our most popular second-hand Mazda cars

29 Apr 2022 Buying A Used Car ArticlesMazda’s Axela, Atenza and Demio are affordable family cars that are really popular in New Zealand. We've broken down what our customers love about them and what makes them special.

Why Toyota is such a popular brand

29 Apr 2022 Buying A Used Car ArticlesToyota is almost the default brand for used car buyers. But what makes Toyota cars, SUVs, utes and vans so popular?

Car Finance Interest Rates

24 Mar 2022 Car FinanceWhen you start looking around the internet for car finance you can expect to see a wide range of car loan interest rates advertised. Making sense of them can sometimes be tricky when at the end of the day all we are really interested in is 'what rate will I...

“Awesome staff, great service, great deals”, said over 2,000 everyday Kiwis!

18 Jan 2022 Community NewsThis year we were chuffed to have been voted #1 for Quality Service by the Reader’s Digest, taking the top spot off Turners in the Used Vehicle Dealership category!